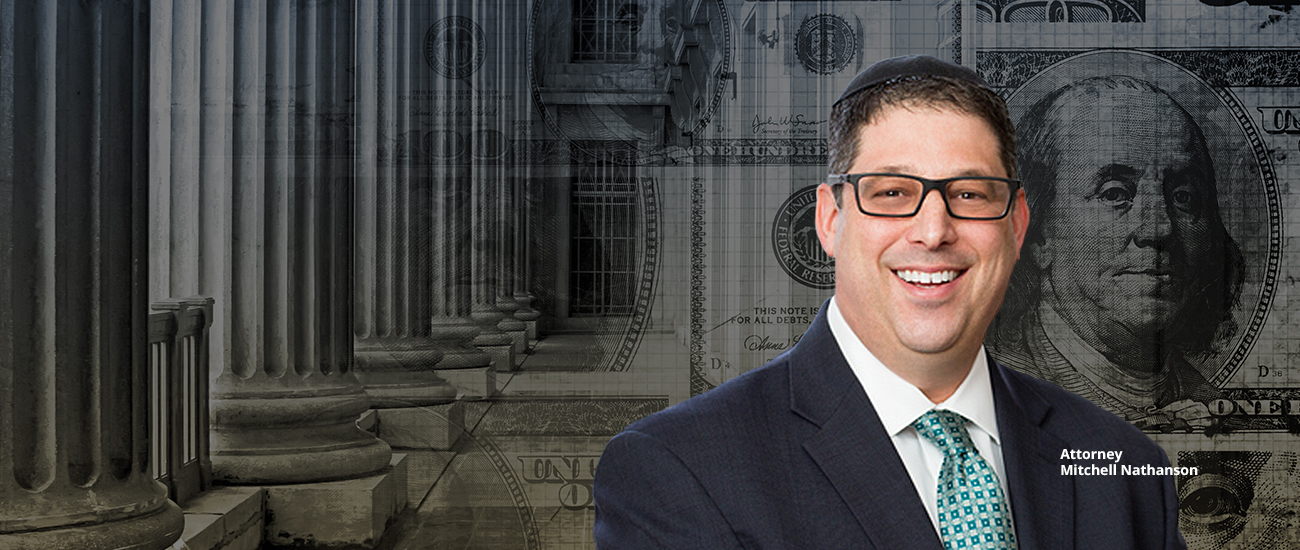

New York Debt Collection Lawyers Protecting Your Interests

New York Debt Collection Lawyers Protecting Your Interests

The Nathanson Law Firm LLP was established on Thanksgiving Day, 2004, with the purpose of servicing our clients locally on Long Island and throughout the country. We have decades of legal experience and are committed to providing the highest level of legal guidance while instilling the utmost confidence in our abilities to aggressively pursue or defend all actions. It is our objective and responsibility to maintain preeminent standards of ethics and professionalism and protect all privileged and confidential information and communication. The Nathanson Law Firm LLP offers a wide range of legal services aimed at protecting the rights, investments and financial security of our clients. We provide straightforward representation in the areas of commercial and retail debt collection, consumer credit transactions, and creditors’ rights, serving clients nationwide from our office in Garden City, NY. When you need to collect a debt or enforce a judgment against a debtor anywhere in the State of New York, a debt collection attorney can provide invaluable guidance.

Our law firm represents both landlords and tenants in Nassau County and Suffolk County (Long Island) with all Landlord & Tenant issues. Buyers and sellers are guided from start to finish of real estate transactions. We will navigate the estate planning process with you including will preparation and testamentary documents, as may be necessary. Our small business clients are counseled to insure proper compliance with local regulations and for all operational needs.

Judgment Enforcement for Creditors

It can be extremely frustrating and time-consuming for creditors attempting to collect unpaid debts or enforce judgments on their own. Often, debtors are difficult to locate and their assets may be harder to find without professional assistance!

To deal with this challenge, our firm uses the most advanced, cutting-edge software to assist in our efforts to collect debts for clients. We constantly update our investigation tools to locate debtors and their assets. Whether a commercial debt is secured or unsecured may make a significant difference in the ability to collect by seizing affected collateral or gaining a priority interest on personal property. In New York, Article 9 of the Uniform Commercial Code (UCC) applies to secured debts of personal property. New York is a “race-record” state, which means certain priorities in judgment enforcement are determined by the earliest date of recording. Likewise, concerning real property, judgment liens are prioritized based upon the date of docketing a transcript of the judgment with the clerk of the county in which the real property is situated. Speed is key, timing is critical and we know it. (Now, so do you!)

In some cases, debtors intentionally attempt to conceal themselves and their assets. We will dissect any information you have obtained and expand the search as information is uncovered. Once we locate a debtor, we may try to negotiate a payment plan arrangement that is secured by a confession of judgment or that triggers a consent judgment clause. This will allow us to enter and enforce a judgment with the court in the event that a debtor defaults under the terms of the payment plan.

However, it may not be possible, or even desirable to negotiate with the debtor and reach an amicable settlement resolution in a timely fashion. In such instances, our New York debt collection lawyers can commence litigation by filing the Summons and Complaint and completing service of process, usually within 30-60 days. We follow a lawsuit to completion through entry of judgment to judgment enforcement proceedings. Tactics to enforce judgments may include wage garnishments via income execution or levying upon bank accounts.

Under New York CPLR Article 52 and similar laws, we can enforce a money judgment against all real and personal property that is not otherwise exempt from judgment enforcement.

Representation in Transactional Matters

Our firm handles legal matters pertaining to real estate, estate planning, and related areas. We handle the negotiation and preparation of residential real property contracts of sale, residential and commercial leases for both landlords and tenants, and we offer counsel to resolve disputes relevant to rent collection, non-payment or holdover eviction proceedings, in both the prosecution and defense of these actions. We will assist in all your estate planning needs, including wills, powers of attorney, living wills, and health care proxies.

Retain a Debt Collection Lawyer in New York from Anywhere in the United States

The Nathanson Law Firm LLP provides knowledgeable representation in the areas of debt collection, enforcement of judgments, and transactional matters, including those involving estate planning, residential real property, and small business law. New York debt collection attorney Mitchell A. Nathanson is a straight shooter with the experience and knowledge to resolve even the most complex debt collection and judgment enforcement matters. Lawyers from many different states have sought the assistance of Mitchell A. Nathanson to domestic their out-of-state judgments for enforcement in New York. We offer multiple billing options, including contingency fee arrangements, flat fees, hourly rates, and a combination of these, and we accept credit card payments from clients. Please call us at 516-568-0000 or use our online form to schedule an appointment if you need a debt collection, landlord-tenant or real estate attorney, or if you are seeking assistance with an estate planning or small business law matter. We serve clients nationwide from our office in Nassau County on Long Island, New York.

Client Reviews

Mitchell Nathanson was a pleasure to work with. He represented me with class and respect. I highly recommend at least doing a consultation with Mitchell to see what he is all about. The care he shows for his clients and his dedication to making sure they reach an agreement that his client can be...

High quality legal work at an affordable price. Initial consultation discussing desired legal services and potential charges. Established a timeline to complete the work. Legal work was completed promptly at the price discussed in the initial consultation. Professional, itemized billing statement...

Mitchell Nathanson is a rarity these days. He is a true professional who does what he says and works hard to get the job done right the first time. You get what you pay for and, with Mitch, you get a highly qualified attorney who puts his clients first. It is definitely worth repeating, Mitch gets...